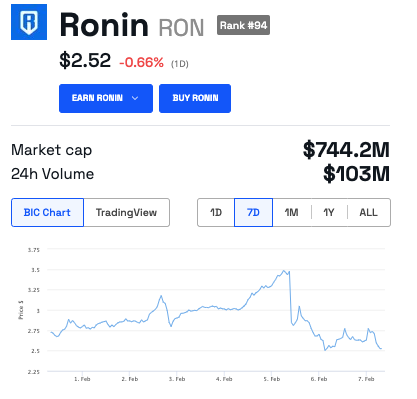

On-chain analytics platform Nansen has discovered that Ronin bridge backer Arca Investments may have inspired the massive Ronin (RON) price dump two days ago. Nansen says Arca made several profit-taking transactions that may have tanked RON’s price by 40%.

Nansen alleges that Arca Investments sold RON as part of a profit-taking exercise following a January accumulation.

Arca Investments’ Role in RON Listing Price Drop

According to Nansen, the price of RON dropped on the same day that Binance announced the listing of RON. This decline was not a coincidence, as Arca Investments, a financial backer of the Ronin bridge, has been cashing out RON profits over the past year and sold on the day of the listing.

Nansen says that, before the Binance sell-off, Arca’s holdings on the Ronin bridge had been increasing. On-chain analysis revealed the company’s holdings rose to $5.7 million after it invested 680 ETH around January 24, 2024. Seven days prior, the company had invested 200 ETH and 500,020 USDC.

One week later, one week before the Binance sell-off, Arca sent 1.5 million RONIN tokens to a new address and sold them into ETH. The company also earned profits from selling RON by being a crypto liquidity provider for the Slow Love Potion (SLP) and wrapped-ETH (wETH) trading pair. Possibly anticipating a price increase, the company sold RON following the Binance listing.

Binance Co-Founder’s Response to RON Price Drop

The RON price collapsed earlier this week following the announcement of its listing on the crypto exchange Binance. Co-founder Hi Ye blamed the RON collapse on the community watching the accumulation of tokens on the blockchain before the listing. On January 16, 2024, Nansen said that Ronin had the highest increase of 192.2% in monthly active addresses.

Ye announced new measures to combat insider trading, including scrapping listings compromised through business relationships. Arca’s sell-off and role in receiving RON tokens from a vesting contract suggest that an exchange’s vetting must consider agreements between token teams and their backers.

Read more: How To Identify a Scam Crypto Project

Insider trading is when people with knowledge of an exchange’s plans accumulate tokens anticipating an increase in their prices after the listing. More broadly, the US Securities and Exchange Commission defines insider trading as follows:

“An “insider” is an officer, director, 10% stockholder and anyone who possesses inside information because of his or her relationship with the company or with an officer, director or principal stockholder of the company.”

Read more: Crypto Social Media Scams

Elon Musk was once accused of insider trading and manipulating the price of Dogecoin (DOGE). Former employees of NFT marketplace OpenSea and Binance competitor Coinbase have previously pleaded guilty to insider trading.

BeInCrypto has reached out to Binance and Ronin bridge developer Sky Mavis but has not heard back at publication time.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.