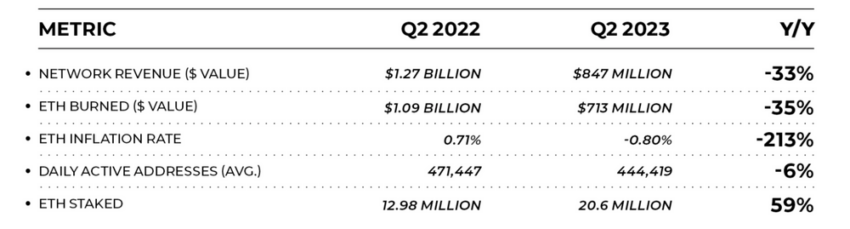

Ethereum network revenue dropped by 33.3% year-over-year in Q2, 2023. Bankless revealed the figure in the report, which also shows a decline in average daily active addresses.

A report from Bankless shows that Ethereum network revenue dropped by a substantial 33.3% in the second quarter of the year. The value dropped from $1.27 billion to $847 million.

Ethereum Network Revenue Takes a Hit

The most significant statistic from the report is the fact that the network revenue dropped by 33.3% compared to Q2 2022. Network revenue is the total value of transaction fees users pay to Ethereum validators, including the corresponding fees that are burned.

Q2 was a lean period for the DeFi market, which likely contributed to the network revenue decline.

Another notable statistic is the 6% decline in average daily active addresses on the network. Ethereum’s inflation rate also decreased by 213%, from 0.71% to -0.8% on average. This is the growth in ETH supply.

It may not have been the strongest quarter for Ethereum, but the network remains the undisputed champion of DeFi. It has shown resilience in what has been a topsy-turvy year.

Ethereum Monthly Burn Surpasses 146,000 ETH

At the same time, Ethereum has surpassed 146,000 ETH in its average monthly burn, with a total of 3,472,331 ETH having been burnt so far. The total amounts to $6.5 billion. This is a sizable sum since the mechanism was introduced with Ethereum Improvement Proposal (EIP) 1559.

The EIP arrived with the London Hard Fork in August 2021 and is responsible for turning Ethereum into a deflationary network. The vast majority of the burns come from typical ETH transfers, NFT activity on major platforms like OpenSea, and high-volume DEXs.

EIP-1559 is responsible for Ethereum burning transaction fees and becoming deflationary. But what exactly is an EIP? Check out our deep dive to learn more: Ethereum EIPs: What Are They? How Are They Implemented?

Ethereum co-founder Vitalik Buterin also recently proposed a method for making crypto wallets simple to use. This method is akin to using an email ID. Buterin made the remarks at the Ethereum Community Conference (ETHCC) in Paris.

The method in question is called modern account abstraction, which Buterin describes as being “really elegant.” It could possibly allow the recovery of the wallet to be as simple as resetting a password for an account. It may be some ways off, but there’s no doubt that this would help Ethereum’s revenue.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.