SatoshiVM’s (SAVM) price experienced a remarkable surge of over 100x after its recent token launch, resulting in substantial profits for early investors.

SAVM has been described as the “first EVM-compatible protocol on BTC with real traction.” It is a Bitcoin layer 2 solution leveraging zero-knowledge (ZK) rollups to address the blockchain network’s inherent limitation of lacking native smart contract functionality.

SAVM Token Launch Highlights

The SAVM token launch unfolded on January 18 and concluded on January 19. According to Bounce Brand, the launch saw participation from 23,487 individuals, with random selection winners receiving SAVM and ILO winners claiming ETH rewards.

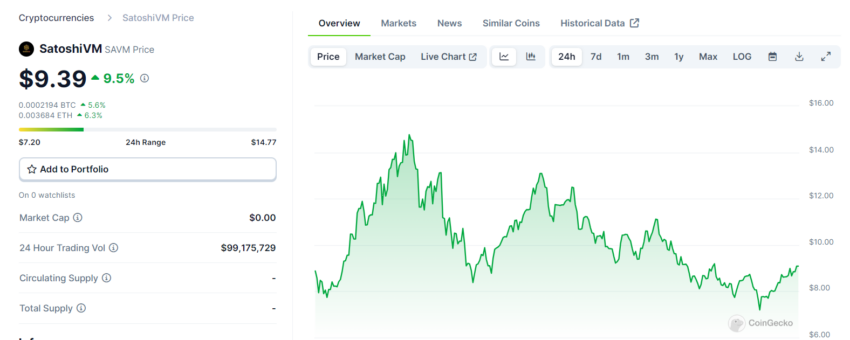

Post-launch, the altcoin’s value skyrocketed, reaching nearly $15. This was propelled by endorsements from various cryptocurrency influencers who promoted the project within their communities.

However, notable on-chain investigator ZachXBT cautioned the community about potential token allocations to these influencers, advising vigilance.

“When influencers with a lot of followers start shilling a project launch at the same time, it is likely [because] they have allocation and will dump their cheap tokens,” ZachXBT warned.

Subsequently, blockchain investigator LookOnChain confirmed ZachXBT’s warning. He revealed that SAVM’s team had allocated 1.2 million tokens (11.5% of the total supply), worth $10.5 million, to 248 influencer addresses. These addresses have sold or transferred over 50% of their holdings, leaving only 483,493 SAVM, equivalent to $4.16 million.

These selling activities notably impacted SAVM’s price, causing it to retrace to approximately $9.39.

Traders Seize Opportunities

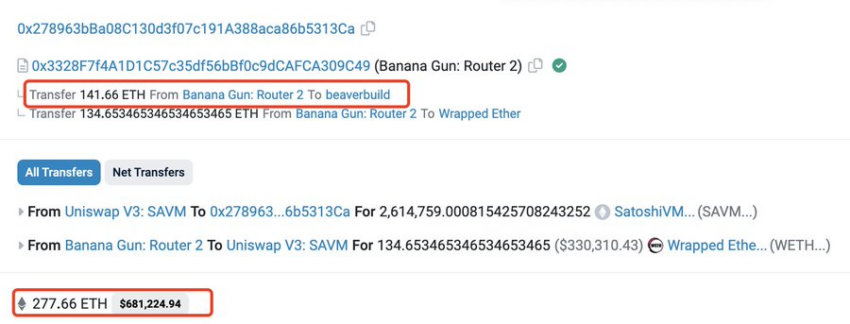

Meanwhile, two savvy traders capitalized on the early stages of the project, amassing almost $8 million in profit. These traders reportedly utilized the Banana Gun bot, a sniping trading bot designed for swiftly purchasing newly launched tokens.

According to LookOnChain, the first trader paid a bribe of 141.66 ETH, approximately $347,350, to secure the first purchase of SAVM at the launch. Consequently, the trader invested 277.66 ETH, equivalent to $681,000, to acquire 2.61 million SAVM.

Read more: 11 Best Altcoin Wallets To Consider In January 2024

Post-purchase, the trader sold around 2.16 million SAVM for $4.38 million, retaining approximately 450,000 SAVM valued at $3.07 million across four different wallets. The overall profit for this trader stands at approximately $6.77 million, reflecting a significant return on the initial $681,000 investment.

Similarly, the second trader paid a bribe of 121.07 ETH, roughly $296,863, to secure the second purchase of SAVM tokens. The trader invested 211.07 ETH, equivalent to $521,000, including fees, to acquire 456,983 SAVM. He later sold 444,483 SAVM for 602 ETH, amounting to $1.49 million, but retained approximately 12,500 SAVM, valued at $125,000.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.