One of the first decisions a crypto investor must make is which trading platform they choose to buy and sell their assets. Yet, deciding which crypto exchange to use for spot trading can be daunting. When deciding which exchange is right for you, there are a few things to consider. Firstly, take note of the transaction fees, as some exchanges charge more than others.

Another important factor is the cryptocurrencies available for trade. So, you may find that some exchanges do not offer your favorite coins. In addition, the trading platform you choose should provide sufficient liquidity and not have any issues with regulation. In this article, we help make your decision easier. Read on to discover the top five spot trading cryptocurrency exchanges for 2023.

BeInCrypto Trading Community on Telegram: read reviews on the best crypto platforms & wallets, get the hottest news on crypto, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is crypto spot trading?

Spot trading in crypto refers to the buying and selling of crypto assets for immediate settling “on the spot.” This means when you buy or sell on a spot exchange, your goal is to trade your crypto or fiat at the current market price quickly. Conversely, futures trading refers to an agreement between a seller and a buyer to trade the asset at a specified price and at a later date.

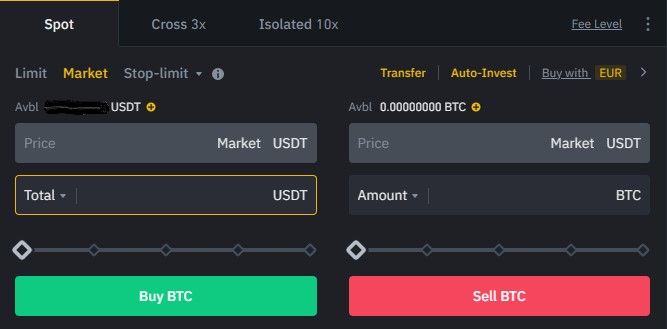

The image below is an example of how spot trading works for buying or selling bitcoin with USDT executed on Binance. To set up a simple trade without any stop limits, just provide your bid details or ask price.

/Related

More Articles

A spot market includes a seller, buyer, and order books. Buyers provide a bid price for the market, which is the highest price they are willing to pay for that asset, and the asking price is the lowest a seller is willing to sell it for. All the bids and asks are recorded in the order book. Essentially, spot traders aim to buy low and sell high. Furthermore, the current price of any asset is referred to as the spot price.

Below we go over some of the top beginner-friendly exchanges for spot trading and the features they offer.

Top 5 Spot Trading Crypto Exchanges

Binance

on trading

Binance is one of the most trusted centralized crypto exchanges that offers a wide range of coins and tokens. The platform provides an intuitive and simple interface that makes it easier to navigate. Apart from being one of the most trusted exchanges for spot trading, trading fees tend to be low and a variety of payment options are available.

- Largest crypto exchange for daily trading volume

- Over 350 spot markets available

- Low trading fees

- Non-transparent corporate structure

- Not available for U.S. clients

Kraken

Kraken provides a high level of security for its users. It’s the only major exchange that hasn’t suffered a security exploit. The platform provides a seamless spot trading environment for beginners as well as seasoned investors.

- Leverage up to 5x

- Great for margin trading

- Advanced trading tools for seasoned investors

- 3.75% charge on debit/credit card payments

eToro

$10 – for US

The eToro platform is a favorite amongst millions of users due to its trust within the community and for its easy-to-use copy trading platform. Traders can enjoy the advantage of copying their trades from other more experienced users. In addition eToro offers perks for those who contribute their own trading strategy.

- Copy trading tools and smart portfolios available

- Beginner-friendly

- Native web and mobile wallet

- 0.5% deposit fee for non-USD payments

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

ByBit

ByBit is a dynamic and highly efficient traidng derivatives trading platform and ensures their customers are provided with optimal trading security. The platform has never been hacked and it’s one of the only crypto exchanges that offers perpetual swap futures for coins EOS and XRP. The exchange offers three product lines to trade on which include derivatives, spot, and options.

- No deposit fees

- Offers a demo account

- Up to 100x leverage

- Not available in the U.S.

- Some trading conditions not suitable for beginners

OKX

OKX is the second largest global exchange for cryptocurrencies and trusted by over 50 million users. Traders can choose from more than 350 tokens and duplicate moves from top traders on the platform. With its fast execution of orders, low fees, and user-friendly interface, it’s no wonder OKX remains a top choice for crypto investors.

- Earn high yields via staking or savings

- Advanced crypto trading products

- Low fees

- Fiat deposit fees are not displayed until after the order

Spot trading comes with risk

Always keep in mind that while you can make good profit spot trading on a cryptocurrency exchange, there are risks to consider. The cryptocurrency market is immensely volatile. Practicing good risk management is key. This includes researching a coin diligently, studying its price history, setting up stop losses, and never investing more than you’re willing to lose. This goes for all types of trading, including grid, futures, and spot trading.

Frequently asked questions

What is the best crypto for spot trading?

What exchange trades the most crypto?

What is the biggest crypto trading market?

What is the safest crypto exchange?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.