The Binance Coin or BNB is supposed to be many things — utility token, staking token, governance token, and a means to push forth cross-chain compatibility. Plus, it is the fourth-ranked crypto globally or third if we exclude Tether — a stablecoin. In this BNB price prediction, we explore everything associated with the price of Binance Coin — from market sentiments to technical analysis and fundamentals.

Also, 2023 was a tough year for Binance, with its Co-Founder Changpeng Zhao stepping down as the CEO. Despite the negative sentiments around, BNB, the native coin of the ecosystem, managed to scale a high of $347.70 in 2023. And this makes us optimistic about the 2024 Binance Coin price prediction.

Want to get BNB price prediction weekly? Join BeInCrypto Trading Community on Telegram: read BNB price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders!

- BNB price prediction and the role of fundamentals

- The DeFi presence of the Binance Coin

- Binance Coin price prediction and the tokenomics

- BNB price prediction and key metrics

- BNB price prediction and technical analysis

- Binance Coin (BNB) price prediction 2023

- Binance Coin (BNB) price prediction 2024

- Binance Coin (BNB) price prediction 2025

- Binance Coin (BNB) price prediction 2030

- Binance Coin (BNB) long-term price prediction until the year 2035

- Is the BNB price prediction model accurate enough?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Binance Coin Price Prediction tool.

BNB price prediction and the role of fundamentals

Binance began life as a cryptocurrency exchange in 2017 led by Changpeng Zhao. Over time, the leading CEX introduced a host of offerings, including the Binance Chains and Binance Academy.

The Binance Coin (BNB) was initially an ERC-20 token but eventually migrated to the Binance Chain as a BEP-2 token. Here are some of the fundamental utilities that make BNB good long-term crypto.

- With BNB, you experience discounted trading fees while on Binance.

- BNB makes it easier for projects to participate in Binance Launchpad-powered IEOs.

- BNB works well with the Binance DEX relevant to the Binance Chain and the governance model relevant to the Binance Smart Chain.

- You can stake BNB on the Binance Smart Chain.

- BNB helps further the vision of dual-chain tokens, establishing smoother interoperability between the Binance Chain and the Binance Smart Chain.

- The Binance Coin helps smooth out token listings on Binance, working as a means to incentivize new launches.

- It helps with liquidity farming, works with Binance marketplace NFTs, and can even be used to top-up your Binance Card — which works more like a debit card.

Each of these use cases adds more weight to the Binance platform and the Binance Coin, inciting optimism about the long-term price of BNB.

Did you know? Lately, BNB Chain has been seeing a surge in transactions, courtesy of inscription minting, more like on-chain NFTs. On November 19, 2023, daily transactions for the BNB Smart Chain surged to 9.5 million.

The DeFi presence of the Binance Coin

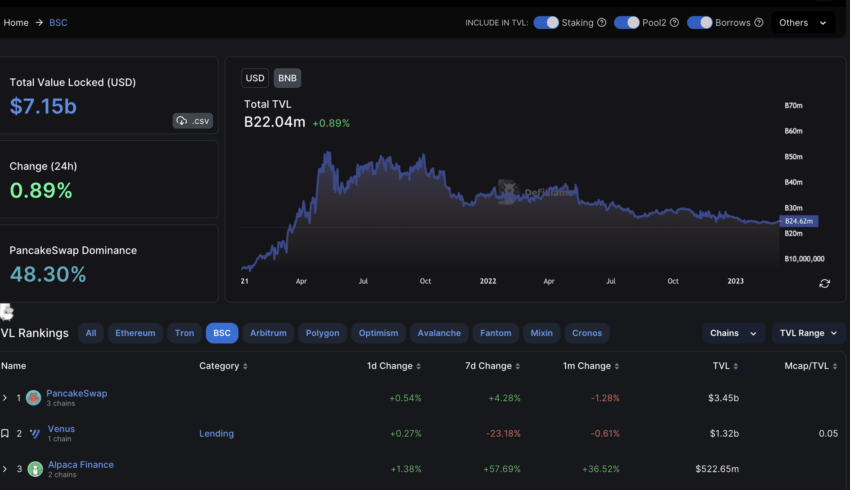

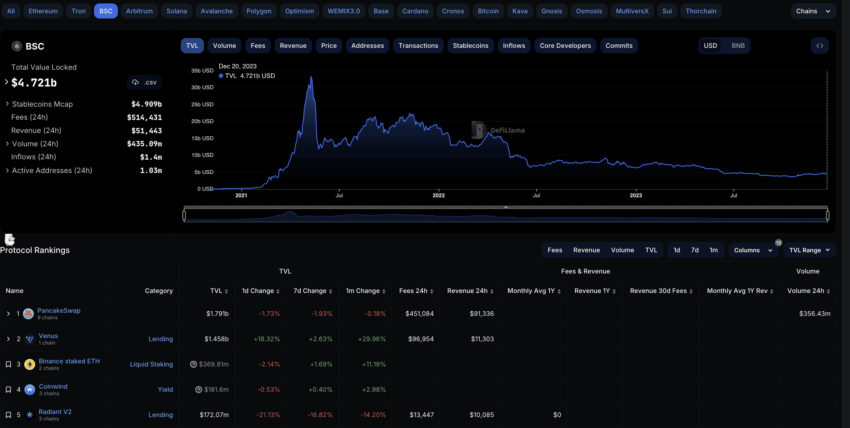

Another reason why the crypto market seems optimistic about BNB is the placement of BSC as the second (currently third) biggest DeFi chain in terms of unlocked TVL. Notice how Pool 2 and even Borrowed coins pushed the BSC TVL to $7.15 billion — or 22.04 million BNB coins in April 2023.

Yes, the DeFi space has simmered down a bit with BSC shedding its DeFi TVL by closing $2.5 billion. However, BSC still holds a significant position in the DeFi space and should be one of the first chains to show activity once the realm gets a move on.

BSC is second only to Ethereum regarding the biggest DeFi chains. For BSC, PancakeSwap is the most dominant DeFi protocol, accounting for almost 49% of the network value.

Binance Coin price prediction and the tokenomics

Before we dive into technical analysis, it is only appropriate to take a closer look at the tokenomics of the Binance Coin.

Here are the key things to take note of:

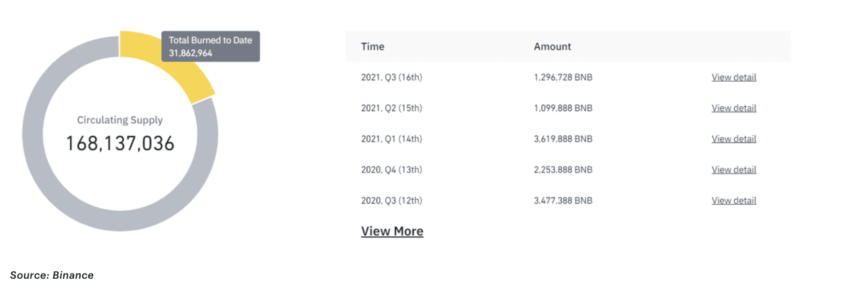

- The maximum supply of BNB is capped at 200 million.

- Yet, a quarterly burn mechanism is in play to make the token economics model deflationary over time.

The last quarterly burn was reported on Jan. 17, 2023. This was the 22nd token-burning incident, with almost $575 million worth of BNB removed from existence.

Coming to the initial distribution, 50% or 100 million BNB went to the retail investors, whereas 40% and 10% went to the founders and angel investors, respectively. Also, as of now, over 151 million coins are in circulation. Plus, the 50% coin allocation focusing on investors enhances the Binance platform’s transparency.

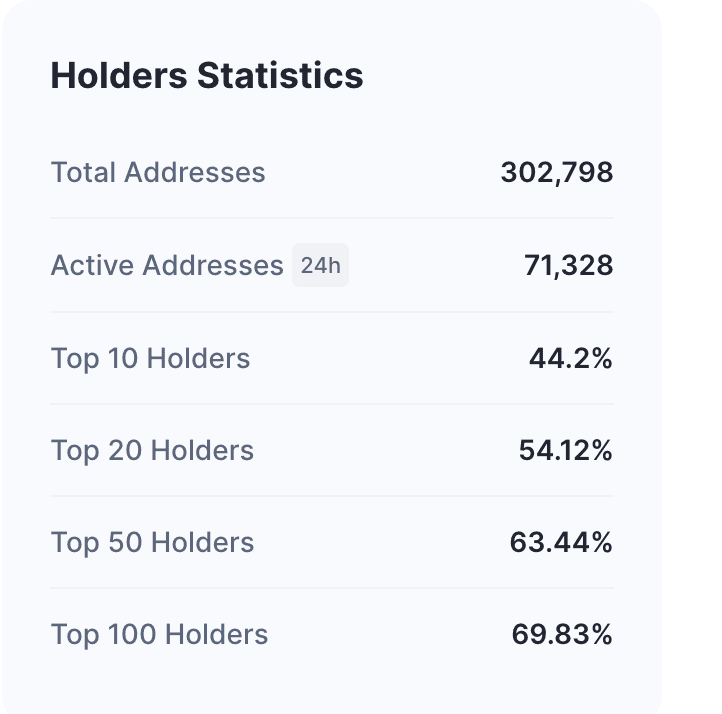

Also, the top holder stats indicate that the top 100 BNB holders control less than 70% of the supply, as of March 2023. This furthers the transparency.

Update: The last BNB burn event happened in June 2023, taking close to 2 million tokens out of circulation.

BNB price prediction and key metrics

As an investor, price volatility is the first metric you should look at. The 4-week volatility chart suggests that the price of BNB usually moves higher every time the volatility line makes a significant bottom.

While the first image is from early April, the latest chart, as of December 20, 2023, shows a flat-lined volatility line.

This could be an optimistic sign for the price action, as a period of minimal volatility often leads to a price surge.

The relationship between the market cap and trading volume is notable. Both metrics have surged since March 10, 2023. An increase in trading volume is good for the price of BNB as it increases liquidity. You can expect a similar price-market cap relationship to hold, going into the future.

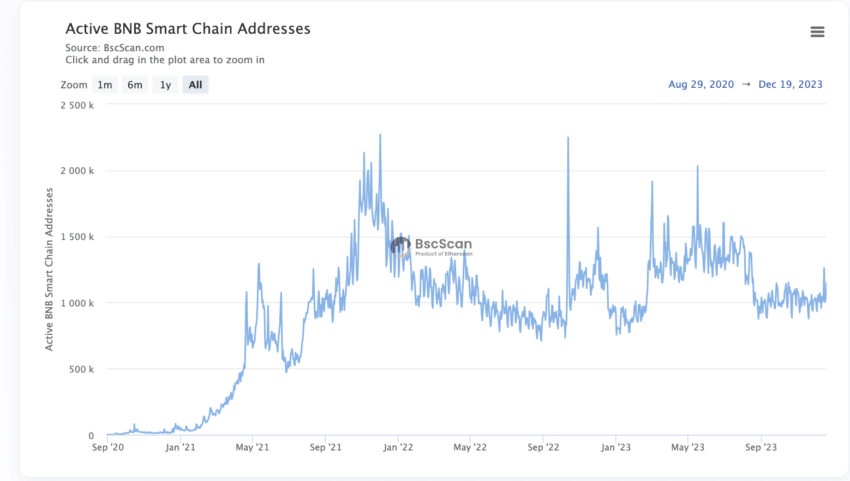

The number of active addresses has remained steady over the past few months. However, this metric grew towards the end of February, with a price rise following.

However, post the surging address count in February 2023, the active BSC addresses have remained flat, putting a question mark in front of the adoption. This metric has to improve for BNB to show a clear bullish sign, in terms of price action.

“Over a million people use BNB Chain every day.”

Changpeng Zhao, Former CEO of Binance: X

Overall, the metrics do hint at price action optimism in the short-to-mid-term.

/Related

More ArticlesBNB price prediction and technical analysis

Our April-March 2023 analysis

We tracked $360 as an important resistance for BNB going deeper into 2023. However, BNB didn’t manage to breach the same, which resulted in a rapid price move. Here is what our analysis comprised:

Our BNB technical analysis from March 16, 2023, shows the $360 level clearly marked as an important resistance. As of now, BNB is trading at $324.50, still far from the important resistance level.

Let us consider another short-term technical analysis to see if things have changed for the price of BNB.

Firstly, the price of BNB is currently trading inside the pennant pattern, closer to the upper trendline. The first level to breach would be $346.50 before it can head toward the $360 mark. However, the path might not be without its share of obstacles.

Notice how BNB is trading in the wake of some bearish RSI divergence. This might lead to some near-term correction, with $316.6 and $274 being the key support levels.

Our December 2023 analysis

The daily BNB/USD chart shows that BNB, for a while, is trading inside a falling wedge. In the presence of high volume, this could be a bullish pattern, with BNB already attempting a breakout from the upper trendline. However, to move towards the bullish zone, the first key level has to be $274.

BNB price prediction December: TradingView

Now, let us circle back to the weekly chart for pattern identification.

Pattern identification

Notice how BNB makes multiple higher high patterns, denoted by A and B. The corresponding lows are marked N and M, respectively. As of now, we might assume that another A-N-B-M pattern is in existence, with only A2 and N2 levels being formed.

The next high could be B2, which might again lead to another low of M2 in the weeks or days to come. Now let us locate the price changes between the intra- and inter-pattern points to get a tentative value of the maximum prices and minimum prices of BNB in the long term.

Price changes

We shall now prepare three tables for three paths, helping you find the key average price percentage values for every low-to-high and every high-to-low transition.

By utilizing the data presented in the tables above, we can determine key values for our analysis. Firstly, using non-negative column values, the average increase from low to high is calculated at 160.84%. This change might occur over a period ranging from 42 to 147 days.

Secondly, the average decrease from high to low, based on negative column values, is found to be 55.35%, which could occur within 7 to 224 days. With these specific values in hand, we shall plot the expected trading price of BNB for both mid-term and long-term projections.

Binance Coin (BNB) price prediction 2023

Our BNB price prediction for 2023 was on track but deviated due to global geopolitical concerns and issues related to the Binance ecosystem. However, we are still optimistic about 2024 as the bull market is expected to come with better and more powerful sentiments.

Here is more about our 2023 price prediction:

We have N2 as the last low on the BNB price chart. We can now use the low-to-high average percentage hike of 160.84% to plot the next high or B2.

This projection puts the BNB price prediction high for 2023 at $573.80 in 147 days (from the tables above). Of course, the timeline and even the projected growth can vary depending on the market sentiment surrounding BNB and the broader health of the crypto market.

The next low, or M2, could surface at a drop of 55.35% — from the calculations above. The maximum timeframe established for the drop is 224 days. Keeping these values in mind, the BNB price prediction for 2023 could drop as low as $256.60. We can mark this level as M2.

Binance Coin (BNB) price prediction 2024

Outlook: Bullish

Keeping the same level of optimism and the traits of a bull market in mind, we can expect the price of BNB to trace the expected path in 2024.

From M2, the low in 2023, we can expect the next high or A3 to surface at $668.10. This aligns with a price hike of 160.84% — per the calculations from earlier. We expect this level to surface by mid-2024. The next low, or N2, could be at a dip of almost 55.35%. This puts the BNB price prediction low for 2024 at $298.30. We can see this level happening towards the end of 2024, marked N3.

Projected ROI from the current level: 160%

Binance Coin (BNB) price prediction 2025

Outlook: Bullish

From N3, the next high, or B3, could again surface at the peak of 160.84% (from earlier). This puts the BNB price for 2025 at $779. The next low could drop as low as $347.20, keeping the 55.35% dip in mind. However, by 2025, we can expect the crypto market to be in a bullish phase, and therefore, the low can surface at a support level of 519.80 — coinciding with A1 from the earlier patterns.

Projected ROI from the current level: 203%

Binance Coin (BNB) price prediction 2030

Outlook: Bullish

The last formed low — in 2025 — might surface at $519.80. From this level, we can expect the new high or A4 to form at $1352.20. This kind of upmove is possible considering the plethora of use cases presented by BNB.

With 2025 low and 2026 high in sight, on extrapolation and following the same growth trajectory as before, the rough trading price of BNB in 2030 can go as high as $11012.90.

Projected ROI from the current level: 4184%

Binance Coin (BNB) long-term price prediction until the year 2035

Outlook: Very bullish

Now that we have the maximum and minimum prices of BNB till 2030, we can extrapolate the calculations and projections to create a price prediction model through 2035.

You can easily convert your BNB to USD here

| Year | | Maximum price of BNB | | Minimum price of BNB |

| 2023 | $573.80 | $256.60 |

| 2024 | $668.10 | $298.30 |

| 2025 | $779 | $519.80 |

| 2026 | $1352.20 | $838.36 |

| 2027 | $2231.13 | $1383.30 |

| 2028 | $3904.47 | $2420.77 |

| 2029 | $8785.07 | $5446.74 |

| 2030 | $11012.90 | $6827.99 |

| 2031 | $16519.35 | $12885.09 |

| 2032 | $24779.02 | $19327.63 |

| 2033 | $29734.83 | $23193.16 |

| 2034 | $37168.53 | $28991.45 |

| 2035 | $44602.24 | $34789.74 |

Is the BNB price prediction model accurate enough?

While this BNB price prediction model correctly captures every aspect of its existence, Binance — being a popular centralized cryptocurrency exchange — might also impact the growth of its native token — BNB. Yet, this BNB price forecast even accounts for the market sentiment that might impact the prices. Overall, with a focus on fundamentals and technical analysis, this BNB price prediction is arguably the most accurate and holistic one around.

Frequently asked questions

What will BNB price be by 2025?

What is the future price of BNB in 2030?

What is BNB’s highest price?

Is BNB a smart investment?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.