Centralized cryptocurrency exchanges (CEXs) are often easy-to-use, intuitive, regulated platforms that make buying and selling crypto easy. However, CEXs are not without drawbacks. Decentralized exchanges offer anonymous alternatives but can come with less customer protection and often higher fees. Services like MoonPay present a distinct offering: a payment processing platform with added bells and whistles. Discover the unique advantages of MoonPay in our detailed review.

MoonPay

- MoonPay

- MoonPay review: Overall assessment

- What is MoonPay?

- What can you trade on MoonPay?

- Where is MoonPay available?

- History of MoonPay

- How to sign up for MoonPay in April 2024?

- Number of users and trading volume

- How does MoonPay compare to others?

- Features and tools from MoonPay

- Pros and cons

- Security and payment processing

- Customer support

- How we have tested MoonPay

- Regulatory compliance and safety

- Invest responsibly

- CEX minus the custody

MoonPay review: Overall assessment

Overall, MoonPay is an exceptional service for cryptocurrency enthusiasts. Although crypto payment services are known for their limited features, this has not limited MoonPay from offering various services in any way.

| Criteria | Fees | Assets | Fiat | Countries | Features | BeInCrypto Score |

|---|---|---|---|---|---|---|

| Score | 3/5 | 4/5 | 4/5 | 5/5 | 5/5 | 4.2 |

What is MoonPay?

Contrary to popular belief, MoonPay is neither a CEX nor a licensed cryptocurrency broker. MoonPay is a cryptocurrency payment processing platform.

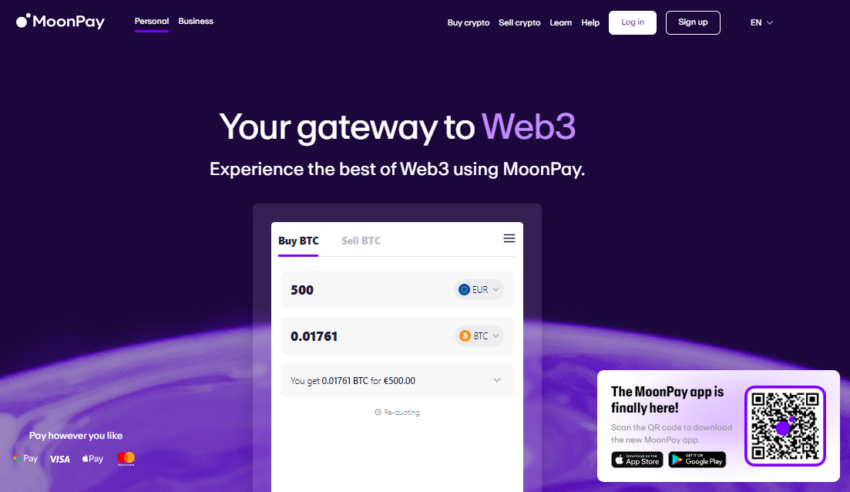

It enables users to buy crypto using traditional payment methods like credit and debit cards and fiat currencies. In other words, MoonPay is a payment service. It simplifies the process of purchasing cryptocurrencies, making it more accessible to individuals and businesses. Legally, it is a licensed money transmitter.

For example, MoonPay is similar to Square, Venmo, and PayPal, as they are licensed money transmitters. On the other hand, Coinbase is similar to Robinhood, a broker, and Kraken is similar to the New York Stock Exchange, an exchange.

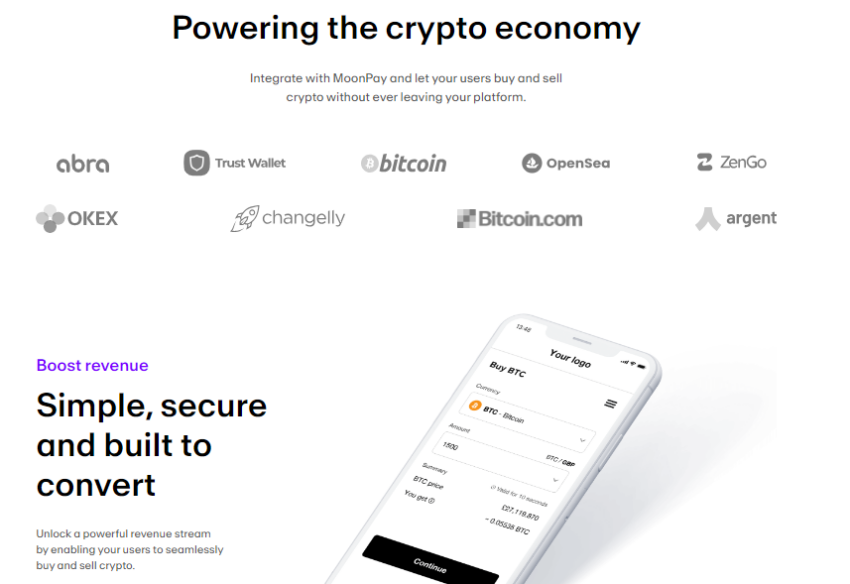

MoonPay provides a white-label solution for cryptocurrency purchases, allowing various cryptocurrency wallets, exchanges, and platforms to integrate MoonPay’s services into their applications. Users can then purchase cryptocurrencies using their credit or debit cards, bank transfers, or other payment methods supported by MoonPay. The company also allows you to sell cryptocurrency.

What can you trade on MoonPay?

At MoonPay, you can actively trade a range of cryptocurrencies, including BTC, ETH, XRP, and LTC. However, as the crypto landscape continually shifts, it’s advisable to frequently consult MoonPay’s platform to stay updated on the latest trading options.

Where is MoonPay available?

MoonPay, a U.S.-based company, holds licenses in the U.S. and parts of Europe but extends its services to over 160 countries. However, several countries and specific U.S. states remain off its accessibility list. These include nations like Afghanistan, China, Russia, and Turkey, among others, and U.S. states such as Louisiana, New York, Texas, and the U.S. Virgin Islands.

History of MoonPay

Ivan Soto-Wright and Victor Faramond founded MoonPay in 2019. They established the company to address the challenges of buying cryptocurrencies easily and securely.

Presently, the company has over 500 partnerships. However, the duo secured their first partnership before the project even launched, following a trip to Tokyo to meet Roger Ver, former CEO of Bitcoin.com.

“We basically had a contract before even building the final product.”

Victor Faramond, MoonPay Co-founder

How to sign up for MoonPay in April 2024?

Unlike traditional centralized exchanges (CEX), where you maintain an account, MoonPay operates as an instant exchange, meaning you don’t hold a typical account with them. Additionally, the registration process with MoonPay is straightforward and simple. You can easily initiate your journey by signing up on their mobile app.

1. First, download the mobile app on Google Play or the Apple Store and select “Continue with Google” or “Continue with email.”.

2. Secondly, choose an email.

Importantly, to buy crypto, you must complete a Know Your Customer (KYC) verification process.

Number of users and trading volume

MoonPay boasts an array of notable metrics. As mentioned earlier, the company proudly partners with over 500 entities. Yet, there’s more depth to MoonPay’s narrative. Their vast user base ranges from a conservative estimate of five million to an impressive count of up to 14 million. Furthermore, MoonPay has facilitated transactions worth around $2 billion and operates actively in over 160 countries worldwide.

How does MoonPay compare to others?

| Platform | Buy Fees | Sell Fees | Assets | Fiat currencies | Supported countries |

|---|---|---|---|---|---|

| MoonPay | 1%-4.5% | 1%-4.5% | 80+ | 39 | 160+ |

| Ramp Network | 1%-5.45% | 1%-5.45% | 90+ | 42 | 150+ |

| Banxa | 1.5%-7.49% | N/A | 150+ | 31 | 130+ |

| Mercuryo | 3.95% | 2.95% | 36 | 21 | 140+ |

MoonPay’s competitors include Ramp Network, Banxa, and Mercuryo. These are all instant exchanges or payment processing services.

Most of the listed competitors offer buy-and-sell services, except for Banxa. MoonPay doesn’t have the highest fees. That title arguably goes to Ramp Network. More accurately, Ramp has the highest possible fees.

Most of the crypto payment services buy and sell fees vary by payment methods, with the exception of Mercuryo. To continue, MoonPay supports most countries. On the other hand, when you adjust for supported fiat, MoonPay is about average. Moreover, Banxa has the most supported assets, coming in at 150 supported cryptocurrencies. However, Ramp Network takes the cake for most fiat currencies supported.

Features and tools from MoonPay

MoonPay is an instant exchange, which means that the services are typically minimal compared to a CEX. However, MoonPay has a multitude of features for users to take advantage of.

To begin, the MoonPay mobile app, available on Android and iOS, offers a convenient way for users to access a wide range of cryptocurrency services. With support for payment methods like Google Pay, Apple Pay, Visa, and Mastercard, it simplifies the process of buying.

MoonPay boasts an extensive selection of over 80 cryptocurrencies, making it a versatile platform for users from more than 160 countries worldwide. Additionally, another standout feature is NFT Checkout, a solution designed to streamline the purchase of non-fungible tokens (NFTs) using a debit or credit card. For high-net-worth individuals looking to invest in NFTs, MoonPay offers MoonPay Concierge, a specialized service available by referral only.

MoonPay doesn’t stop at individual users; it also caters to businesses. The platform provides HyperMint NFT APIs and SDKs, making it effortless for NFT creators to build and mint their own tokens.

Lastly, MoonPay offers a suite of APIs and widgets for seamless integration into businesses, enabling them to incorporate MoonPay’s cryptocurrency services directly into their platforms.

/Related

More ArticlesIn summary, here is a list of MoonPay features:

- MoonPay Mobile app (Android and iOS)

- Payment methods (Google Pay, Apple Pay, Visa, Mastercard)

- 80+ cryptocurrencies

- 160+ countries

- 39 fiat currencies supported

- NFT Checkout

- MoonPay Concierge

- HyperMint

- MoonPay APIs and widgets for business integration

- Wallet management

Fees

In the case of fees, MoonPay has two types: buying and selling fees. Buying fees incur a processing fee dependent upon the payment method. For card payments, the fees are as follows:

- Card payments: 4.5% with a €3.99/£3.99/$3.99 (or equivalent currency) minimum

- Bank transfers: 1% with a €3.99/£3.99/$3.99 (or equivalent currency) minimum

- P2P bank transfers: 1.5%

- PIX: 2.95%

For selling, the processing fees are slightly different.

- United Kingdom/United States bank transfer: 1% with a €3.99/£3.99/$3.99 (or equivalent currency) minimum

- Sell to card: 4.5% with a $3.99 minimum

MoonPay SDK

The MoonPay SDK is a tool designed to simplify and enhance the integration of MoonPay’s cryptocurrency buying, selling, and NFT services into various applications within the web3 space.

MoonPay has developed this development toolkit for its 500+ partners, including wallets, exchanges, and NFT marketplaces. It reduces the integration time, requiring just a two-step, script-based installation to handle interactions with the MoonPay API.

One of the standout features of the MoonPay SDK is its customization and theming capabilities. Partners have full control over the widget’s appearance, allowing them to match it seamlessly with their brand identity. This customization extends to fonts, colors, borders, and more. Moreover, it currently supports JavaScript for embedding the widget within webpages, with plans to introduce React Native and native SDKs in the near future.

Additionally, the SDK offers a range of layout options, including overlay, new tab, new window, embedded, and drawer, catering to different user interface preferences.

It also includes an embedded event system that updates users’ transaction statuses in real-time. Furthermore, the MoonPay SDK prioritizes maintaining the partner’s branding throughout the user journey. Users can complete transactions without leaving the native app.

Pros and cons

MoonPay, like any platform, has its strengths and weaknesses. What exactly are these advantages and disadvantages?

Pros

- Supports multiple countries and fiat currencies

- Wide variety of cryptocurrencies to purchase

- Fiat on-ramp and off-ramp

- API integrations for businesses in need of payment services

- NFT integrations for businesses

- Supports swaps in mobile app

Cons

- Fees are relatively high compared to competitors and CEXs

- Licenses limited to U.S. and select countries in Europe

- Limited cryptocurrency offerings for U.S.

Security and payment processing

MoonPay implements various security measures, including restricted access to computer systems and limited physical access to areas where data is processed. The company may store and process user data in the U.S. and other locations worldwide, ensuring compliance with applicable laws and regulations.

MoonPay’s employees must follow data protection laws and have limited access to sensitive customer information. Unauthorized use or disclosure of such information is strictly prohibited.

Users are also encouraged to protect their personal information by selecting secure passwords and promptly reporting any unauthorized account access. Moreover, MoonPay places a strong emphasis on security, using industry-standard practices to protect user data and financial information during transactions.

This includes complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to ensure the legitimacy of transactions.

Moreover, since MoonPay does not hold user funds or provide wallet software, users using MoonPay as a third-party crypto on-ramp/off-ramp will need to have their own cryptocurrency wallet in order to receive and keep cryptocurrency.

For the Ethereum and Bitcoin blockchains, MoonPay Accounts do provide a wallet; however, for all other cryptocurrencies, MoonPay acts as an intermediary cryptocurrency on-ramp/off-ramp, not retaining user funds or providing wallet applications.

As a result, crypto payment processing platforms like MoonPay are non-custodial. They do not carry the same unsecured creditor risk as a centralized exchange or a broker.

Payments

MoonPay offers a variety of accepted payment methods to accommodate both U.S. and non-U.S. residents. For customers who are not U.S. residents, MoonPay accepts credit/debit cards, including MasterCard, Visa, and Maestro.

Additionally, users can make payments through Apple Pay and Google Pay, with Google Pay support available exclusively on Android devices. Non-U.S. residents can also utilize SEPA and SEPA Instant for transactions denominated in euros, specifically in SEPA countries. In the U.K., GBP-denominated transactions are facilitated through U.K. Faster Payments. Furthermore, MoonPay extends support to Nigerian customers by enabling P2P transfers in Naira (NGN) via Yellow Card. For users in Brazil, transactions denominated in Brazilian Real (BRL) can be completed using PIX.

Conversely, U.S. residents can access a slightly simplified selection of payment methods when purchasing through MoonPay. They can use credit/debit cards, including MasterCard, Visa, Maestro, and Apple Pay. Google Pay is also available for U.S. residents but is supported exclusively on Android devices.

These diverse payment options aim to cater to users’ specific needs and preferences in different regions, ensuring accessibility and convenience for all. Users should keep in mind that there are limits associated with MoonPay’s services. For example, the USD limit is $11,940, while the Euro limit is €9,950. Your bank may also place limits on the amount of crypto that you can purchase.

There is also a $30 minimum purchase for cryptocurrency. Limits and restrictions vary by cryptocurrency, fiat currency, and payment methods.

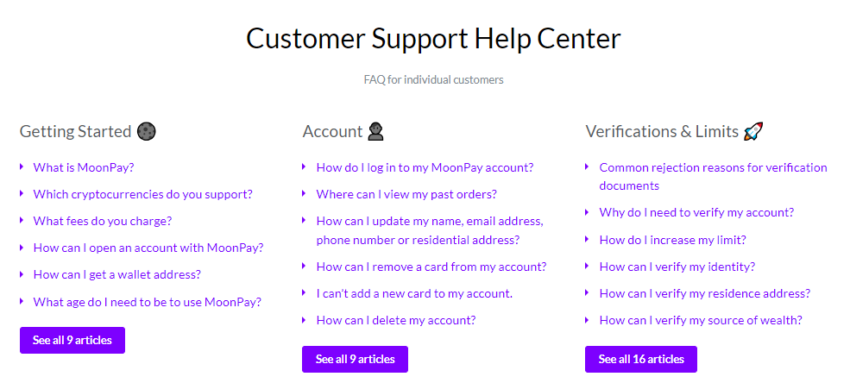

Customer support

Regarding MoonPay’s customer support, there is little information on their procedures and policy. If you have trouble with MoonPay’s services, the support center covers most imaginable scenarios that you can think of. If you need further support, raising a request for support is quick and easy. Our requests were answered within 48 hours, and we found the support team knowledgeable and friendly.

In the case of customer reviews, MoonPay receives overwhelmingly positive reviews, according to Trustpilot. Most of the reviews cite fast and easy transactions as the reason for their positive remarks.

How we have tested MoonPay

In order to offer our comprehensive view of this platform, we dove deep into MoonPay’s core platform offerings, especially focusing on the following areas:

- Digital asset wallet capabilities

- Tools for reviewing transaction histories and reports

- Features related to cryptocurrency trading

- Features related to cryptocurrency swapping

- Mobile financial services

- Security protocols and safeguards

We used all of MoonPay’s signature offerings over a period of weeks and tested its customer services department, approaching the team with a number of queries.

Regulatory compliance and safety

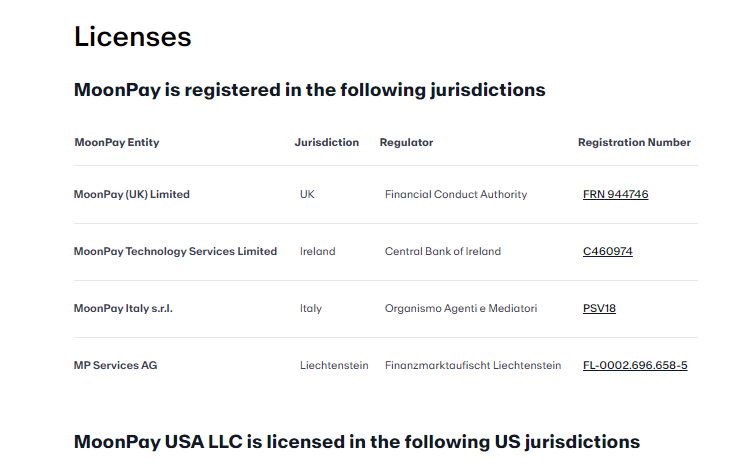

Given the current regulatory environment, what MoonPay review is complete without commenting on its regulatory status? As far as the U.S. is concerned, MoonPay holds a money transmitter or equivalent license in 43 states.

It also holds a foreign exchange license in Guam. In the case of Europe, MoonPay holds licenses in the U.K., Ireland, Italy, and Liechtenstein under multiple subsidiaries.

In the United Kingdom, MoonPay (U.K.) Limited is licensed by the Financial Conduct Authority. For Ireland, MoonPay Technology Services Limited holds a license from the Central Bank of Ireland. In Italy, MoonPay Italy s.r.l. is licensed by Organismo Agenti e Mediatori. Lastly, in Liechtenstein, MP Services AG is licensed by Finanzmarktaufsicht Liechtenstein.

Invest responsibly

Always bear in mind that investing carries inherent risks, and there’s a potential for financial loss. While this MoonPay review provides insight, it doesn’t officially endorse the service. Instead, we present this review primarily for informational value for newbies and experts alike. Before making any investment decisions, users should carefully weigh their personal financial goals and commitments.

CEX minus the custody

This MoonPay review finds that the platform offers a niche service for cryptocurrency enthusiasts. When you account for its competitors, the service offers a variety of unique features. If you require the fiat on-ramp services offered by a centralized exchange without the custodial services, payment services like MoonPay are where you want to be.

Frequently asked questions

MoonPay has fees based on buying and selling crypto. Both buy and sell fees vary based upon payment method. Card payments have the highest fees. Both buying and selling crypto incur a 4.5% fee.

MoonPay is regulated as a licensed money transmitter in most U.S. states. Companies that are regulated have certain consumer protections to indemnify users in necessary circumstances. However, it is important to note that after you purchase crypto from MoonPay, it is sent to your personal wallet. In this sense, it does not have the same risks associated with a centralized exchange.

A number of countires cannot use MoonPay. These include Afghanistan, Albania, Anguilla, Aruba, Bangladesh, Barbados, Belarus, Bermuda, Bolivia, Botswana, Burkina Faso, Cambodia, Cayman Islands, Central African Republic, China, Congo, Cook Islands, Cote D’ivoire, Cuba, Dominica, Ecuador, Fiji, Ghana, Guinea-Bissau, Haiti, Hong Kong SAR, China, Iceland, Iran, Iraq, Jamaica, Japan, Jordan, Korea, North, Kosovo, Lao People’s Democratic Republic, Lebanon, Liberia, Libya, Macao SAR, China, Malaysia, Mali, Malta, Mauritius, Mongolia, Morocco, Myanmar, Nepal, Nicaragua, Pakistan, Palau, Palestine, Panama, Papua New Guinea, Philippines, Puerto Rico, Russia, Samoa, Senegal, Seychelles, Solomon Islands, Somalia, South Sudan, Sri Lanka, Sudan, Syrian Arab Republic, The Democratic Republic Of The Congo, Timor-Leste, Trinidad and Tobago, Tunisia, Turkey, Turks and Caicos Islands, Uganda, Ukraine, Vanuatu, Venezuela, Virgin Islands British, Yemen, Western Sahara, Zimbabwe. MoonPay is also not available in the following U.S. states: Louisiana, New York, Texas, and U.S. Virgin Islands.

MoonPay does not offer any special offers or bonuses. The payment service has integrations into other businesses and applications. These other services may have bonuses associated with using MoonPay; however, MoonPay does not.

There is not much information available on MoonPay’s customer support. The company does however have a support center that covers a multitude of scenarios for users. Beyond this, not much is known regarding MoonPay’s customer support procedures and policies.

MoonPay does not have a minimum deposit. It does not maintain an account for users in the same way that a centralized exchange does. The company does however have a minimum purchase amount of $30.

MoonPay does not have withdrawals in the same way that a centralized exchange (CEX) does, as it does not maintain customer accounts like CEXs do. However, transaction times complete in minutes. Additionally, bank transfers complete in between one and three days.

Yes MoonPay has a mobile app. It is available on Android and iOS. With it, you can buy and swap crypto.

MoonPay does not offer a demo account. It is a payments service that processes crypto transactions. It does not maintain customer accounts in the same way that a centralized exchange does.

MoonPay is a payments processing service. It maintains a money transmitter license in most U.S. states. MoonPay is similar to services such as PayPal, Square, or Venmo.

Yes, MoonPay is a regulated money transmitter in most U.S. states. The company is also regulated in parts of Europe. Some of these include the U.K., Ireland, Italy, and Liechtenstein.

MoonPay provides services for both casual users and businesses. It allows users to instantly purchase crypto with their credit or debit card. However, one of the drawbacks of using MoonPay is that it has high fees.

MoonPay allows users to purchase crypto instantly with a debit or credit card. Transactions are sent to your personal wallet. Therefore, crypto payment processing services like MoonPay do not have the same risks as centralized exchanges.

The biggest disadvantage to using MoonPay are the fees. Both buy and sell fees onMoonPay are 4.5%. This is much higher than centralized exchanges and crypto payment processing alternatives.

MoonPay does not maintain users’ accounts in the same way that a centralized exchange does. Therefore, you can not withdraw from MoonPay. However, you can sell crypto to MoonPay.

Whether the MoonPay app is safe or not largely depends on how you use it. The MoonPay app has limited features. You can only buy and swap crypto, you cannot hold crypto. Therefore the risks are limited.

MoonPay is licensed in in the U.S. and parts of Europe. However, it is available in over 160 countries. MoonPay is primarily a U.S. based company.

MoonPay limits vary by currency. The USD limit is $11,940, while the Euro limit is €9,950. Your bank may also place limits on the amount of crypto that you can purchase.

No, MoonPay does not have a withdrawal fee. MoonPay does not maintain users’ accounts in the same way that a centralized exchange or brokerage maintains users’ accounts. It is merely a payment transmitting platform.

No, you cannot store money on MoonPay. It is a payments platform that allows you to transmit money. It does not maintain users’ accounts in the same way that an exchange does.

Yes, you can transfer money from MoonPay to your bank account. However, you can not transfer money from a MoonPay account. You can sell crypto to MoonPay and receive the payout in your bank account.

Yes, MoonPay requires KYC. You can verify your identity on MoonPay using passports, government ID, and other documents. MoonPay implements KYC to prevent money laundering.

Yes, MoonPay is legitimate. It has licenses in most U.S. states and parts of Europe. Additionally, MoonPay implements KYC to prevent money laundering.

No, you can not withdraw money from MoonPay. The company also does not hold users’ funds. When you purchase crypto from MoonPay, the crypto is sent directly to your personal wallet.

MoonPay is simply a money transmitting service. It does not hold users’ funds in the same way that a centralized exchanges does. Therefore, it does not carry the same risk as being an unsecured creditor to an exchange.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.